5 401k match calculator

Protect Yourself From Inflation. You only pay taxes on contributions and earnings when the money is withdrawn.

Customizable 401k Calculator And Retirement Analysis Template

In other words if you want to contribute 100month and.

. For example if your employer matches up to 3 percent. As an exampl See more. Your 401k plan account might be your best tool for creating a secure retirement.

Many employers choose to match you 401 k contributions up to certain limits. Apply your companys match percentage to your gross income for the contribution pay period. The annual rate of return for your 401 k account.

Brought to you by Sapling. First all contributions and earnings to your 401 k are tax deferred. You expect your annual before-tax rate of return on your 401 k to be 5.

Ad Ensure Your Investments Align with Your Goals. In the following boxes youll need to enter. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

The actual rate of return is largely. Now a 401K contribution is determined by taking a percentage of your income rather than an amount of the income. IRA and Roth IRA.

For a matching contribution to meet safe harbor 401 requirements it must use one of the following three formulas. A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement. A 401k match is an employers percentage match of a.

It provides you with two important advantages. 10 Best Companies to Rollover Your 401K into a Gold IRA. In this example you would enter 3.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Searching for Financial Security. 10 Best Companies to Rollover Your 401K into a Gold IRA.

Protect Yourself From Inflation. If for example your contribution percentage is so high that you obtain the 20500 year 2022 limit. Basic match 100 on the first 3 of compensation plus a.

A 401k match is an employers percentage match of a participating employees contribution to their 401k plan usually up to a certain limit denoted as a percentage of the employees salary. Titans 401 k calculator gives anyone the ability to project potential returns from a 401 k retirement fund based on your current age 401 k balance and annual salary. The employer match helps you accelerate your retirement contributions.

Our Financial Advisors Offer a Wealth of Knowledge. Your employer match is 100 up to a maximum of 4. NerdWallets 401 k retirement calculator estimates what your 401 k balance will.

That means your employer also contributes money to your 401 k account. Find a Dedicated Financial Advisor Now. Please visit our 401K Calculator for more information about 401ks.

Many employees are not taking full advantage of their employers matching contributions. If the employee wants to withhold more than 4 percent of gross wages the benefit will match 50 percent up to 4 percent of the gross wages. Pre-tax Contribution Limits 401k 403b and 457b plans.

23 5 401k match calculator Sunday September 4 2022 The second most popular formula for employer matching. This calculator assumes that your return is compounded annually and your deposits are made monthly. A 401 k can be one of your best tools for creating a secure retirement.

The benefit will be calculated as. Your current before-tax 401 k plan. His 20 Grand Slam titles are third most all-time just behind Nadals 22 and Novak Djokovics 21.

For every dollar you contribute to your qualified retirement plan your employer will also make a contribution to your. In the US the traditional IRA Individual Retirement Account and Roth IRA are also popular forms of. There can be no match without an employee contribution and not all 401ks offer employer matching.

5 hours agoFederer has had one of the best careers in the history of the sport.

Here Is What You Could Expect In Retirement If You Use A 401k Tsp 403b 457 Or Ira As Your Retirement Investment Investing For Retirement Investing Stock Market

The 16 Skeptical Questions I Asked Before Buying An Iul And You Should Too Universal Life Insurance Life Insurance Premium Life Insurance Policy

Valuist How To Prioritize Your Savings Money Management Emergency Fund Prioritize

Doing The Math On Your 401 K Match Sep 29 2000

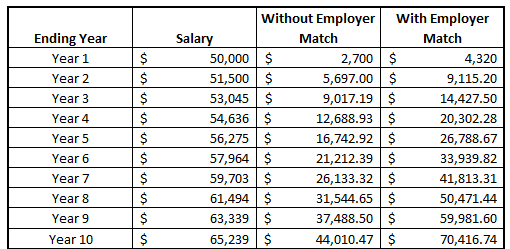

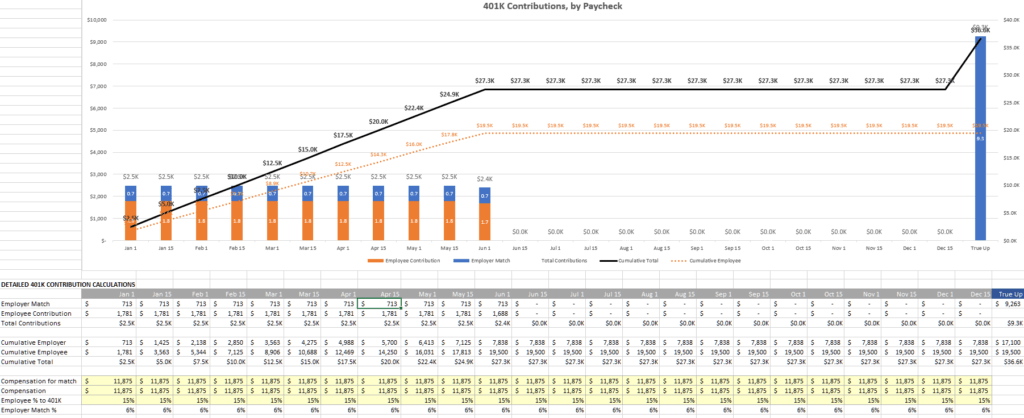

401k Contribution Calculator Step By Step Guide With Examples

401k Employee Contribution Calculator Soothsawyer

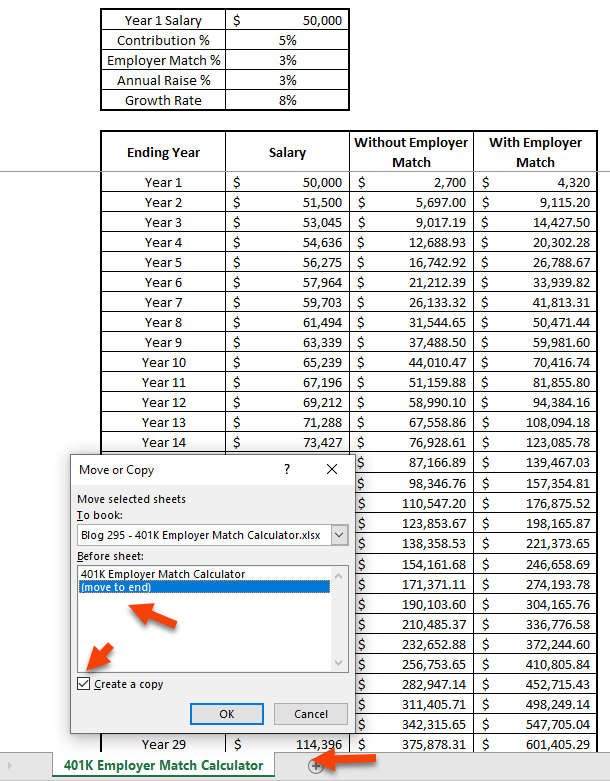

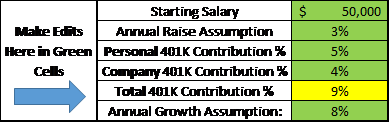

Take Control Of Your Own Destiny With This 401k Employer Match Calculator

Take Control Of Your Own Destiny With This 401k Employer Match Calculator

This 401k Match Calculator Shows How Powerful Compound Interest Can Be

Ultimate Retirement Calculator Our Debt Free Lives Retirement Calculator Retirement Calculator

Free 401k Calculator For Excel Calculate Your 401k Savings

401k Contribution Calculator Step By Step Guide With Examples

Traxpayroll Solutions Traxpayroll Solutions Payroll Software Filing Taxes

401k Contribution Calculator Step By Step Guide With Examples

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Employee Compensation Plan Template Luxury Employee Total Rewards Statement Total Pensation Excel Templates Tuition Reimbursement How To Plan

401k Employee Contribution Calculator Soothsawyer